The jewelry has began 2014 on a hot ability and lately hopped above a key technical signal that increases the case for ongoing benefits ahead.

Front-month gold futures trading on Saturday hopped returning above the 200-day shifting regular, a line that many graph viewers use as a guide to forecasting long-term styles. The before gold exchanged above its 200-day shifting regular was Feb. 11, 2013.

The latest ability noticeable only it all time since 1979 in which gold exchanged below the 200-day shifting regular for more than a season, according to Unique Financial commitment Group. The other instances took place in the first half of 1998, Oct 1989 and Aug 1982.

“Gold has been performing well all season, and the fact that it has now shifted above its 200-day is another very good,” Unique says. “The action around the 200-DMA over the next several days should give an indicator whether this brief flirtation above will become a more long lasting pattern.”

Front-month gold futures trading on Saturday hopped returning above the 200-day shifting regular, a line that many graph viewers use as a guide to forecasting long-term styles. The before gold exchanged above its 200-day shifting regular was Feb. 11, 2013.

The latest ability noticeable only it all time since 1979 in which gold exchanged below the 200-day shifting regular for more than a season, according to Unique Financial commitment Group. The other instances took place in the first half of 1998, Oct 1989 and Aug 1982.

“Gold has been performing well all season, and the fact that it has now shifted above its 200-day is another very good,” Unique says. “The action around the 200-DMA over the next several days should give an indicator whether this brief flirtation above will become a more long lasting pattern.”

The Elegant Royal Canadian Mint is a coin that is of a higher cleanliness than any other gold coin available for sale to the public. These coins involve 99.999% pure gold.

The most definitely exchanged gold agreement for Apr distribution increased Wednesday for a Tenth straight period, lately trading up 0.4% at $1,324, the biggest level since Oct. 31. Stronger-than-expected information from China suppliers ongoing to repel objectives that the globe's biggest customer of the jewelry is seeing an financial recession, which is giving a increase to gold prices.

China drawn $10.76 billion dollars of foreign direct purchase of January—up 16.1% on season, the nation's Secretary of state for Business said. Those numbers come on the pumps of trade information launched last week that revealed an surprising increase in both imports and exports, yet another sign of health in an economic system that was expected to slowly after years of widespread growth.

Although traders often view China information as vulnerable to distortions, the high energy reviews have been enough to further energy a move that has seen the jewelry rise nearly 10% since the beginning of the season.

The most definitely exchanged gold agreement for Apr distribution increased Wednesday for a Tenth straight period, lately trading up 0.4% at $1,324, the biggest level since Oct. 31. Stronger-than-expected information from China suppliers ongoing to repel objectives that the globe's biggest customer of the jewelry is seeing an financial recession, which is giving a increase to gold prices.

China drawn $10.76 billion dollars of foreign direct purchase of January—up 16.1% on season, the nation's Secretary of state for Business said. Those numbers come on the pumps of trade information launched last week that revealed an surprising increase in both imports and exports, yet another sign of health in an economic system that was expected to slowly after years of widespread growth.

Although traders often view China information as vulnerable to distortions, the high energy reviews have been enough to further energy a move that has seen the jewelry rise nearly 10% since the beginning of the season.

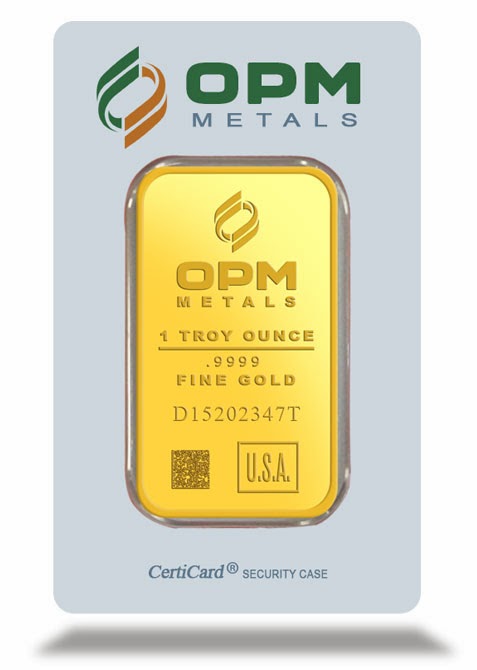

These smooth silver gold are made by Ohio Precious Materials which is The united state's biggest refiner of "good delivery" precious metals products.

The move has been motivated by trader issues that a flagging U.S. restoration may slowly the speed at which the Federal Source comes returning its stimulation program. Gold is often used as a protect against financial doubt and weak point in the money, which has been harm by the Fed’s connection buying policy.

Still, gold has a lengthy way to go from recapturing latest failures suffered lately. Gold decreased 28% in 2013, its first drop in 13 years. The gold continues to be down 30% from its record settle high of $1,888.70 achieved in Aug 2011.

Despite the latest move in gold and silver prices, some traders remain reluctant to get extremely favorable on the gold and silver.

“While we are in no hurry to buy either, we cannot neglect the technical enhancement made in latest weeks,” said Jonathan Krinsky, primary market specialist at MKM Associates.

The move has been motivated by trader issues that a flagging U.S. restoration may slowly the speed at which the Federal Source comes returning its stimulation program. Gold is often used as a protect against financial doubt and weak point in the money, which has been harm by the Fed’s connection buying policy.

Still, gold has a lengthy way to go from recapturing latest failures suffered lately. Gold decreased 28% in 2013, its first drop in 13 years. The gold continues to be down 30% from its record settle high of $1,888.70 achieved in Aug 2011.

Despite the latest move in gold and silver prices, some traders remain reluctant to get extremely favorable on the gold and silver.

“While we are in no hurry to buy either, we cannot neglect the technical enhancement made in latest weeks,” said Jonathan Krinsky, primary market specialist at MKM Associates.

No comments:

Post a Comment